The amount of TDS deducted and deposited is also mentioned. Part A of Form 26AS- Details of Tax Deducted at Source contains details of TDS deducted on all income sources such as salary, interest income, pension income and winning prize, etc. Part A: Details of Tax Deducted at Source: Part G: TDS Defaults* (processing of defaults).Part F: Details of Tax Deducted on sale of immovable property u/s194IA (For Buyer of property).Part C: Details of other Tax Paid than TDS or TCS.Part B: Details of Tax Collected at Source.Part A2: Details of TDS on sale of Property u/s194(IA).Part A1: Details of TDS for Form 15G/Form 15H.Part A: Details of Tax Deducted at Source.Now, one needs to fill two separate forms for filing the income tax return on the income generated on AY 2019-2021. They have also extended the submission date of Form 26AS from 31st August to 31st of December. They have introduced a few new rules in this pandemic via Rule 114-I in Finance Act. These changes are made under section 285BB in the Income Tax Act,1961 through Finance Act 2020.

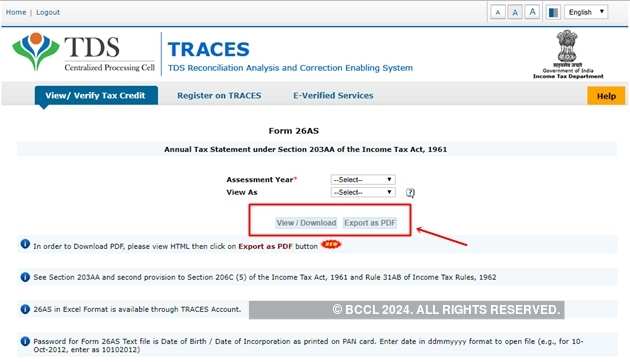

The central government of India has announced these changes via a notification on the 28th of May, 2020. Now, the Income-tax department has introduced some new rules and changes due to the COVID-19 pandemic in 2020. Except if you are a salaried employee then you can only fill up the Form16 provided by your employer or download it yourself from the income tax department’s official website. Apart from your Income declaration, you also need to fill out the detailed information of all taxes you have paid during the year such as TCS ( Tax Collected at Source). You can be held against that so always make sure to check the Form 26 AS before submitting. If the records don’t match the Income-tax department records of the particular accounting year. This form contains detailed information on the income generated from multiple jobs against your PAN (Permanent Account Number). Form 26AS is a solidified statement and declaration of income for the particular accounting year by a taxpayer under section 203AA of the Income Tax Act,1961. It also includes all the information regarding any advance tax such as withholding tax or self-assessment tax you have paid throughout the year.

This form is a statement against the tax that has been collected on your behalf through your employer, bank, tenant.

0 kommentar(er)

0 kommentar(er)